Compliance, Taxes, and Risk Management for Ticket Resellers

Regulation around ticket resale is a patchwork of local rules, platform policies, and consumer protection laws. Treat compliance as a product feature: predictable, transparent, and auditable.

Consumer disclosures

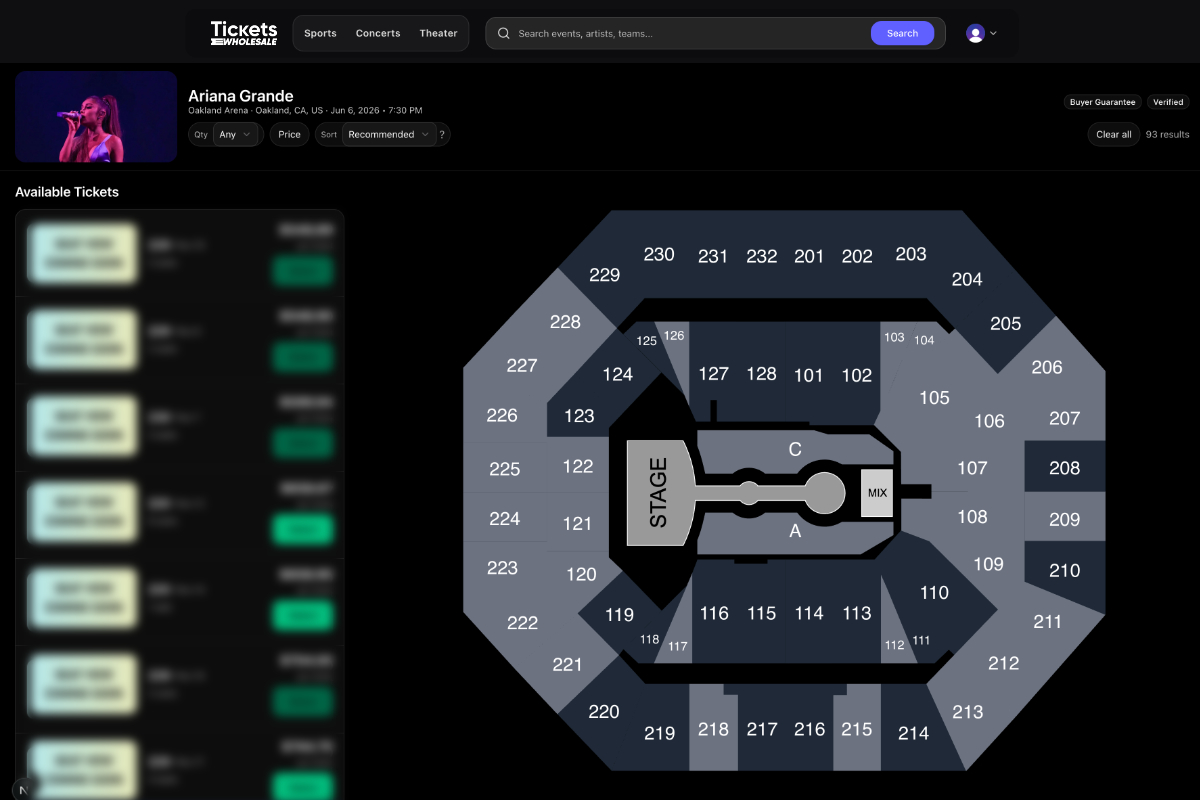

- Display face value, seat attributes, and delivery method clearly.

- Communicate estimated delivery windows and last-mile handoff (mobile transfer, AXS, Ticketmaster, etc.).

- Honor refund policies and keep them consistent with platform terms.

Jurisdictional considerations

Some states and provinces restrict speculative listing and require licensure. Keep a registry of where you operate and what rules apply. When in doubt, avoid speculative claims and overbroad guarantees.

Taxes and invoicing

Set clear rules for when sales tax/VAT applies and who remits. Use invoicing that references event IDs, sections/rows, and transfer IDs. Reconcile daily to reduce month-end crunch.

Chargeback prevention

- Use strong descriptors and send delivery confirmations with metadata.

- Require 3DS or IDV on high-risk cards; maintain allow/deny lists.

- Track reason codes and implement targeted fixes (e.g., better seat disclosures).

Operational risk

Build playbooks for supplier failures, venue changes, or canceled shows. Keep a small reserve inventory buffer. Document make-good policies ahead of time to move fast under pressure.

Good compliance is invisible to buyers but highly visible in your financials.